UNLOCKING CONSUMER PREFERENCES: INSIGHTS FROM THE AUSTRALIAN PIE MARKET

In a market teeming with choices, understanding what drives consumer preferences is crucial for any brand aiming to secure a lasting place in the hearts, and shopping carts, of its audience.

This case study takes a deep dive into the Australian pie market, offering a comprehensive analysis of how some of the country’s most recognised brands succeed in converting brand awareness into consumer preference.

Although the focus is on pies, the insights gathered here extend beyond this niche, providing valuable lessons in branding, consumer behaviour, and market positioning that can be applied across various industries.

Case Study Overview:

This study is designed to uncover how effectively different pie brands convert brand awareness into consumer preference. It also examines consumer perceptions of key product attributes like quality, taste, and value, and ultimately offers actionable strategies for marketers to enhance their brand’s positioning, loyalty, and consumer engagement.

To gather these insights, we teamed up with one of Australia's largest online panels, surveying a nationally representative audience of n=400 Australians across the country. This robust data collection approach ensures that the findings are reflective of the diverse preferences and attitudes of consumers nationwide, providing marketers with a comprehensive understanding of the market landscape.

SECTION 1: BRAND AWARENESS VS. PREFERENCE CONVERSION

Data Presentation

The relationship between brand awareness and consumer preference is a critical factor in a brand’s success, yet these two metrics do not always move in sync. Awareness is merely the first hurdle a brand must clear to be considered by consumers, but preference is where the real value lies, it’s what drives purchases and builds lasting loyalty.

In this section, we explore the data that reveals which brands are leading in awareness and, more importantly, which ones are successfully converting that awareness into a loyal customer base.

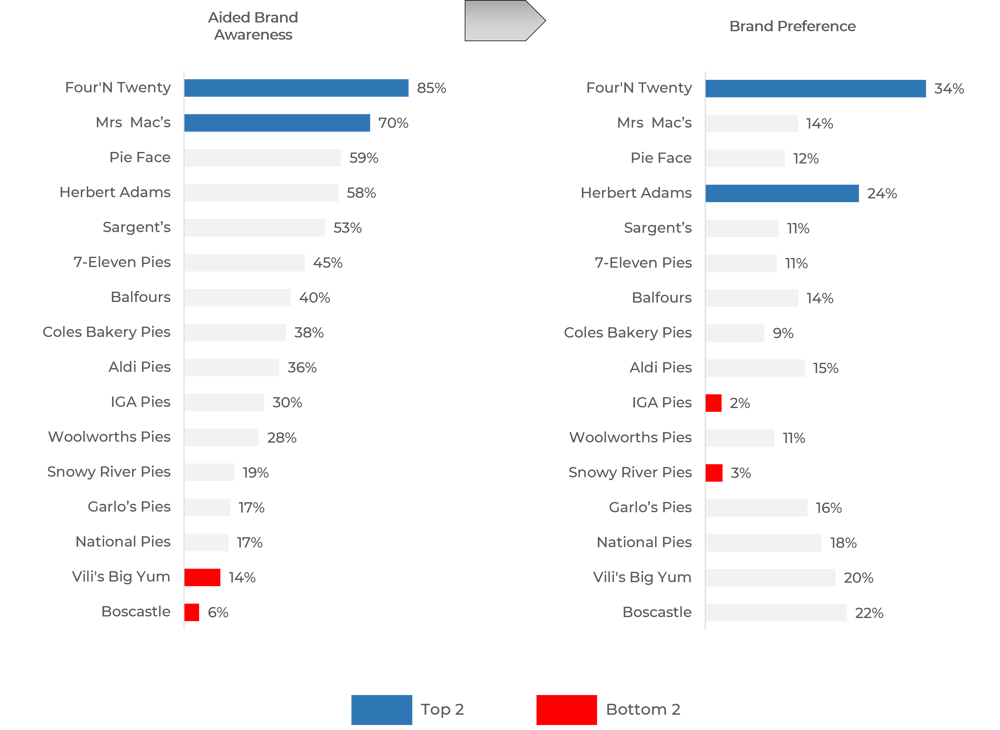

Four'N Twenty emerges as the most recognised brand, with a staggering 85% of respondents indicating awareness of the brand. This high level of recognition is matched by a robust preference conversion rate of 34%, demonstrating a strong alignment between consumer awareness and preference.

Herbert Adams follows closely with a 58% awareness rate and an impressive 24% conversion rate, underscoring its effectiveness in building brand loyalty.

Meanwhile, Boscastle and Vili's Big Yum, though lower in overall awareness (6% and 14% respectively), show strong conversion rates of 22% and 20%, suggesting that once consumers are aware of these brands, they are likely to choose them as their preferred option.

Conversion Score Analysis

Understanding why some brands excel at converting awareness into preference while others struggle provides crucial insights for marketers. For instance, Four'N Twenty’s leadership in the market, with a 34% conversion rate, can be attributed to its longstanding presence, strong brand identity, and consistent product quality that resonates with a broad audience. This brand's ability to turn awareness into preference highlights the importance of maintaining a robust and consistent brand image over time.

Herbert Adams also stands out, particularly in its appeal to older demographics. With a 24% conversion rate, Herbert Adams capitalises on its premium positioning and strong association with quality, which are critical factors in its success.

On the other hand, brands like Garlo’s Pies and Aldi Pies (Bramwells) demonstrate moderate conversion rates, at 16% and 15% respectively. These brands have managed to cultivate a loyal customer base, but there is still significant potential for growth. Enhancing product differentiation and tailoring marketing efforts more precisely could help these brands increase their market share and strengthen consumer preference.

Conversely, some brands face notable challenges. IGA Pies (Black & Gold or IGA Signature), with the lowest conversion rate of 2%, despite a 30% awareness rate, indicates a significant disconnect between consumer recognition and brand preference. This gap may stem from issues related to product quality, pricing, or overall brand perception. Snowy River Pies also struggles, with only 3% of consumers who are aware of the brand selecting it as their preferred choice, suggesting that there are underlying issues preventing these brands from capitalising on their market presence.

Key Takeaways

The disparity between awareness and preference conversion across different brands highlights several critical insights. First, brand consistency emerges as a key driver of success. Brands like Four'N Twenty show that consistent brand messaging, quality, and market presence are essential for building and maintaining strong consumer loyalty.

Second, the importance of differentiation cannot be overstated. For brands with lower conversion rates, there is a clear need to reassess market positioning and explore ways to stand out. Whether through product innovation, enhanced quality, or more targeted marketing, these brands need to bridge the gap between being known and being chosen by consumers.

Targeted marketing strategies tailored to specific demographics can play a significant role in increasing brand preference. For instance, Herbert Adams could further leverage its appeal among older consumers, while brands like Garlo’s Pies might focus on strategies to attract younger demographics, thereby enhancing their overall market performance.

SECTION 2: CONSUMER PERCEPTIONS OF QUALITY, TASTE, VARIETY, AND VALUE FOR MONEY

In the dynamic Australian pie market, understanding consumer perceptions across key attributes: quality, taste, variety, and value for money, is essential for brands aiming to strengthen their market position. Each of these attributes not only influences immediate purchase decisions but also shapes long-term brand loyalty.

In this section, we delve into how consumers perceive these attributes across various brands, taking into account each brand’s strategic market positioning.

QUALITY PERCEPTION: The Premium vs. Mainstream Dichotomy

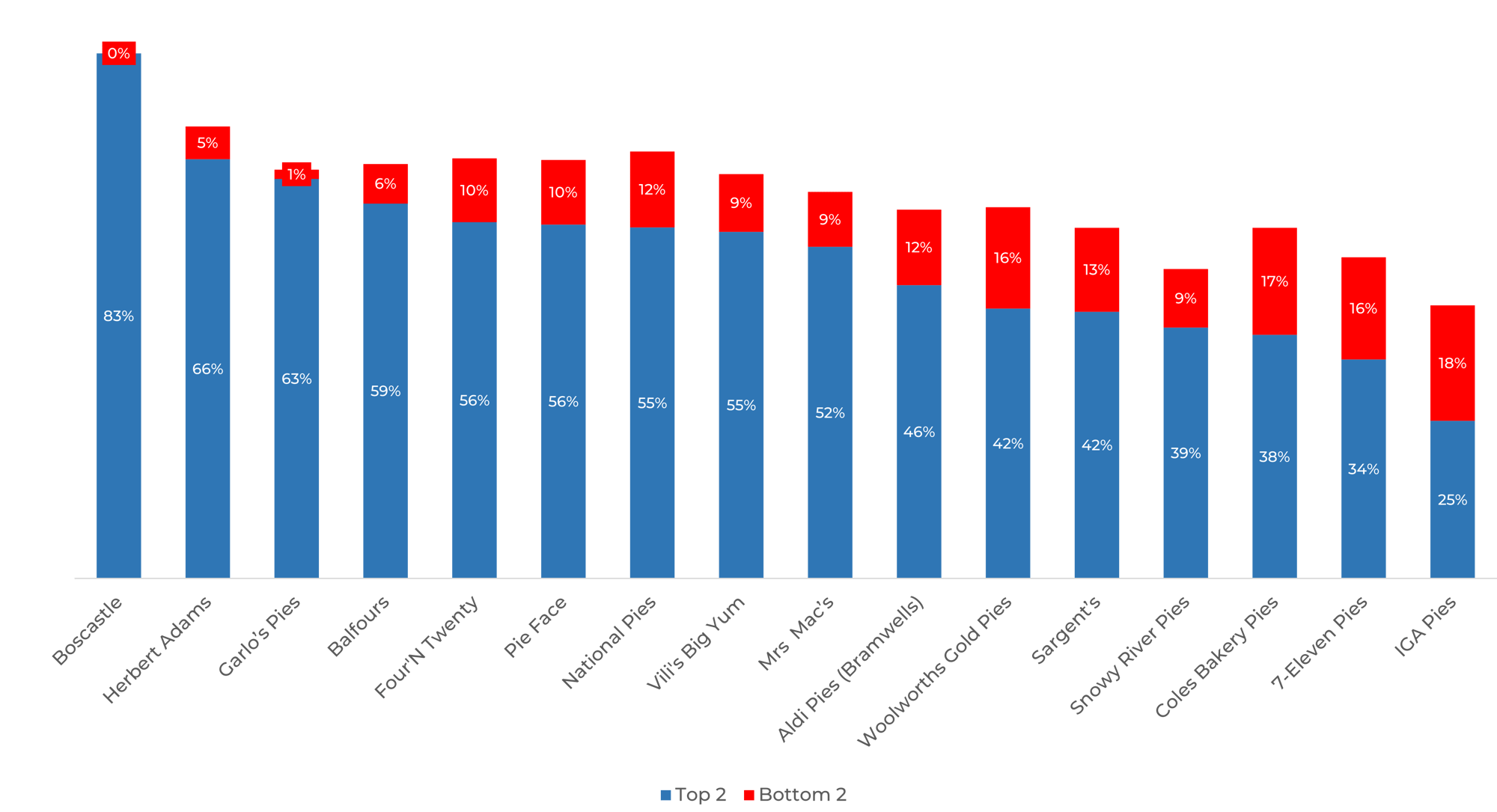

Quality is a critical attribute, especially for brands that position themselves in the premium segment of the market. Boscastle leads the industry with 83% of consumers rating its pies highly in quality, and a negligible 0% rating them poorly. This aligns perfectly with Boscastle’s premium positioning, where high quality is a non-negotiable standard.

Similarly, Herbert Adams and Garlo’s Pies also receive strong quality ratings, with 66% and 63% in the Top 2 Box, respectively. Both brands have successfully established themselves as premium options in the pie market. Their low Bottom 2 Box scores (5% for Herbert Adams and 1% for Garlo’s Pies) further reinforce their reputations as reliable providers of high-quality products. For these brands, maintaining high quality is essential to justifying their premium pricing and maintaining consumer loyalty.

On the other hand, Four'N Twenty and Pie Face, which are more mainstream and widely accessible, also perform well in terms of quality with 56% and 55% Top 2 Box scores. However, their slightly higher Bottom 2 Box scores (10% each) indicate that while their quality is generally appreciated, they face more variability in consumer perceptions. This could be due to their broader target market, where they need to balance quality with price accessibility.

Lower down the quality spectrum, IGA Pies and Snowy River Pies have the most room for improvement. With 25% and 39% of consumers, respectively, rating them positively, these brands may struggle to justify their positioning unless they make significant enhancements in quality. For IGA Pies in particular, the relatively high 18% Bottom 2 Box score suggests that many consumers perceive a gap between the brand's offering and its pricing, which could be detrimental if left unaddressed.

TASTE: Driving Consumer Loyalty Through Flavour

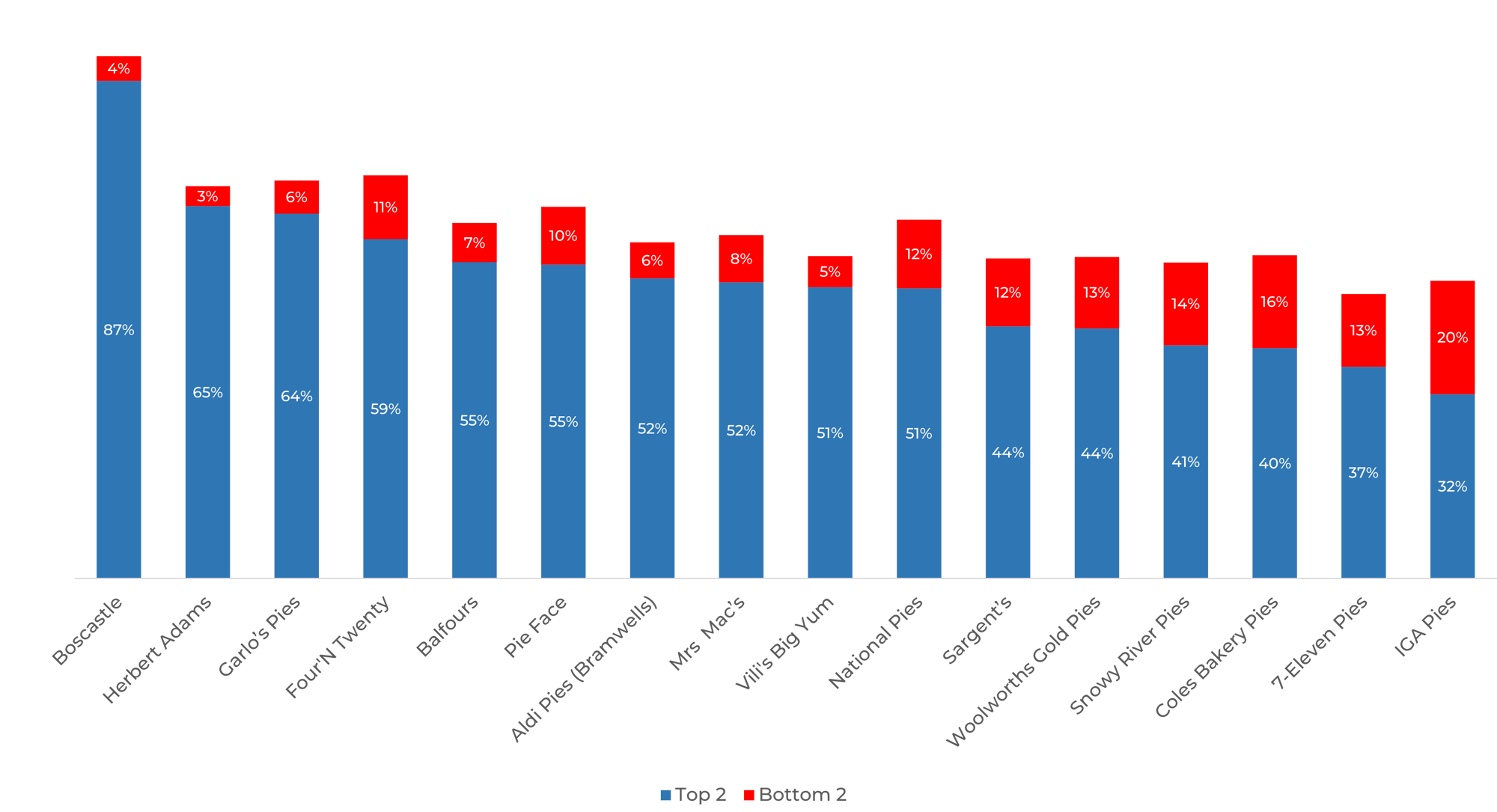

Taste is often the deciding factor that turns a one-time buyer into a loyal customer. Boscastle again leads in this category, with 87% of consumers rating its taste highly—a clear reflection of its commitment to delivering a premium flavour experience. The brand’s low 4% Bottom 2 Box score further solidifies its top-tier status, confirming that its flavour profile meets the high expectations set by its premium positioning.

Herbert Adams and Garlo’s Pies also excel in taste, with 65% and 64% Top 2 Box scores, respectively. These brands are known for their flavourful offerings, and their relatively low Bottom 2 Box scores (3% and 6%) suggest that they consistently meet consumer taste expectations. Maintaining this strong flavour profile is crucial for these brands to continue justifying their premium pricing.

Mainstream brands like Four'N Twenty and Pie Face also perform well in taste, with 59% and 55% Top 2 Box scores. However, their higher Bottom 2 Box scores (11% and 10%) indicate that while they appeal to a broad audience, they may face challenges in consistently delivering a high-quality taste experience across their wide distribution networks.

At the lower end, IGA Pies and 7-Eleven Pies struggle with taste, with 32% and 37% of consumers placing them in the Top 2 Box. Their higher Bottom 2 Box scores (20% and 13%) suggest that these brands may not meet the taste expectations of a significant portion of their consumer base. For these brands, improving flavour profiles could be a key strategy for increasing consumer satisfaction and loyalty.

VARIETY: Catering to Diverse Consumer Preferences

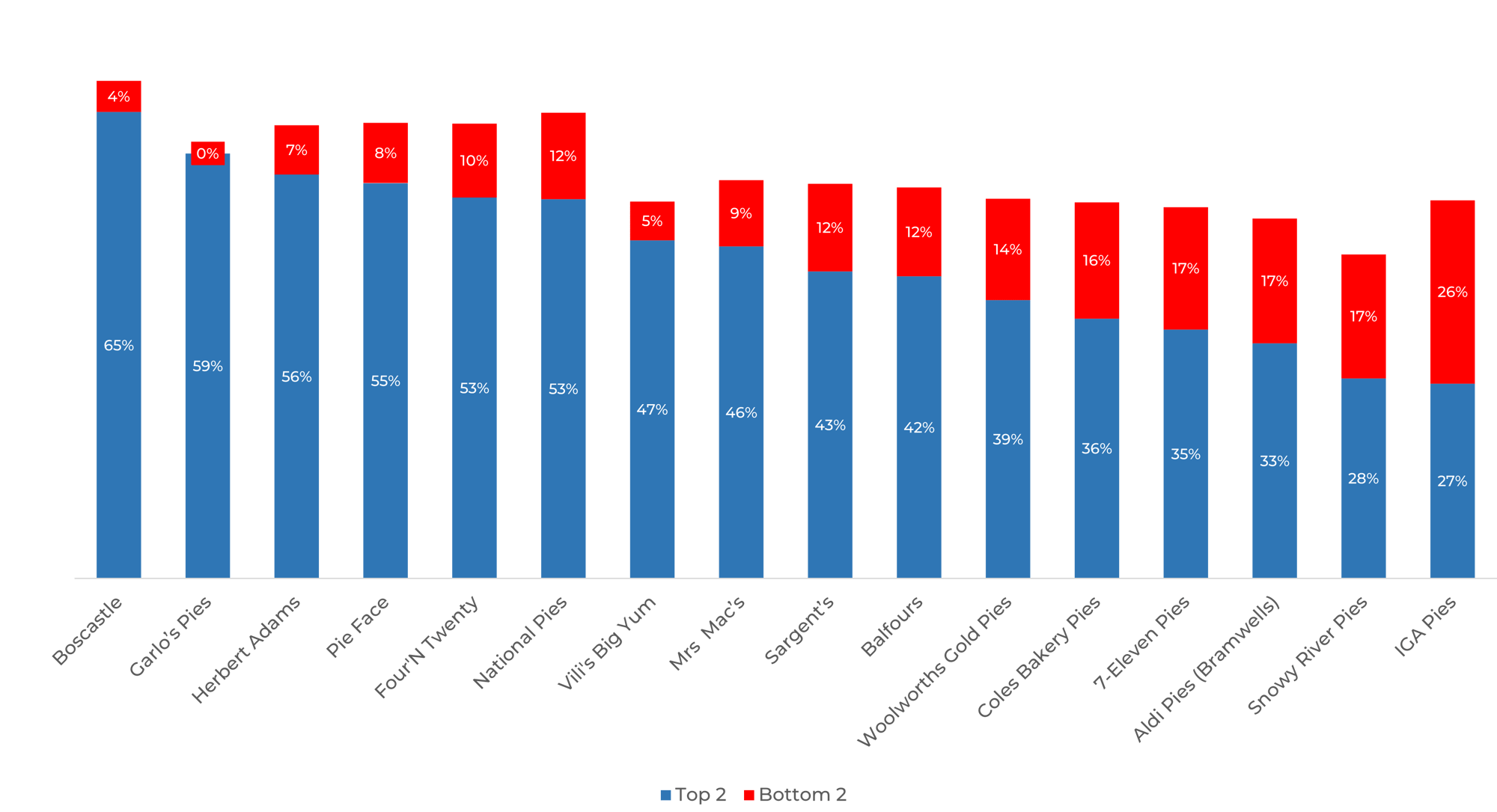

Variety is essential for brands looking to cater to a wide range of consumer tastes and dietary needs. Boscastle once again leads, with 65% of consumers appreciating its range of options. This strong variety offering aligns with its premium positioning, where providing a diverse product lineup helps justify its higher price point.

Garlo’s Pies also stands out with 59% of consumers rating its variety highly and an impressive 0% rating it poorly. This indicates that Garlo’s Pies successfully meets consumer demand for diverse options, which is likely a key factor in its brand preference among discerning customers.

For brands like Four'N Twenty and Pie Face, variety is important but more challenging to manage given their broader market reach. With 53% and 55% Top 2 Box scores, these brands are doing well but have room to expand their offerings to meet diverse consumer needs better. Their higher Bottom 2 Box scores (10% and 8%) suggest that some consumers feel their variety is lacking.

Lower-performing brands in terms of variety, such as IGA Pies and Snowy River Pies, with 27% and 28% Top 2 Box scores, may need to broaden their product lines to stay competitive. Given that IGA Pies has a 26% Bottom 2 Box score, it’s clear that expanding variety could significantly enhance its market appeal.

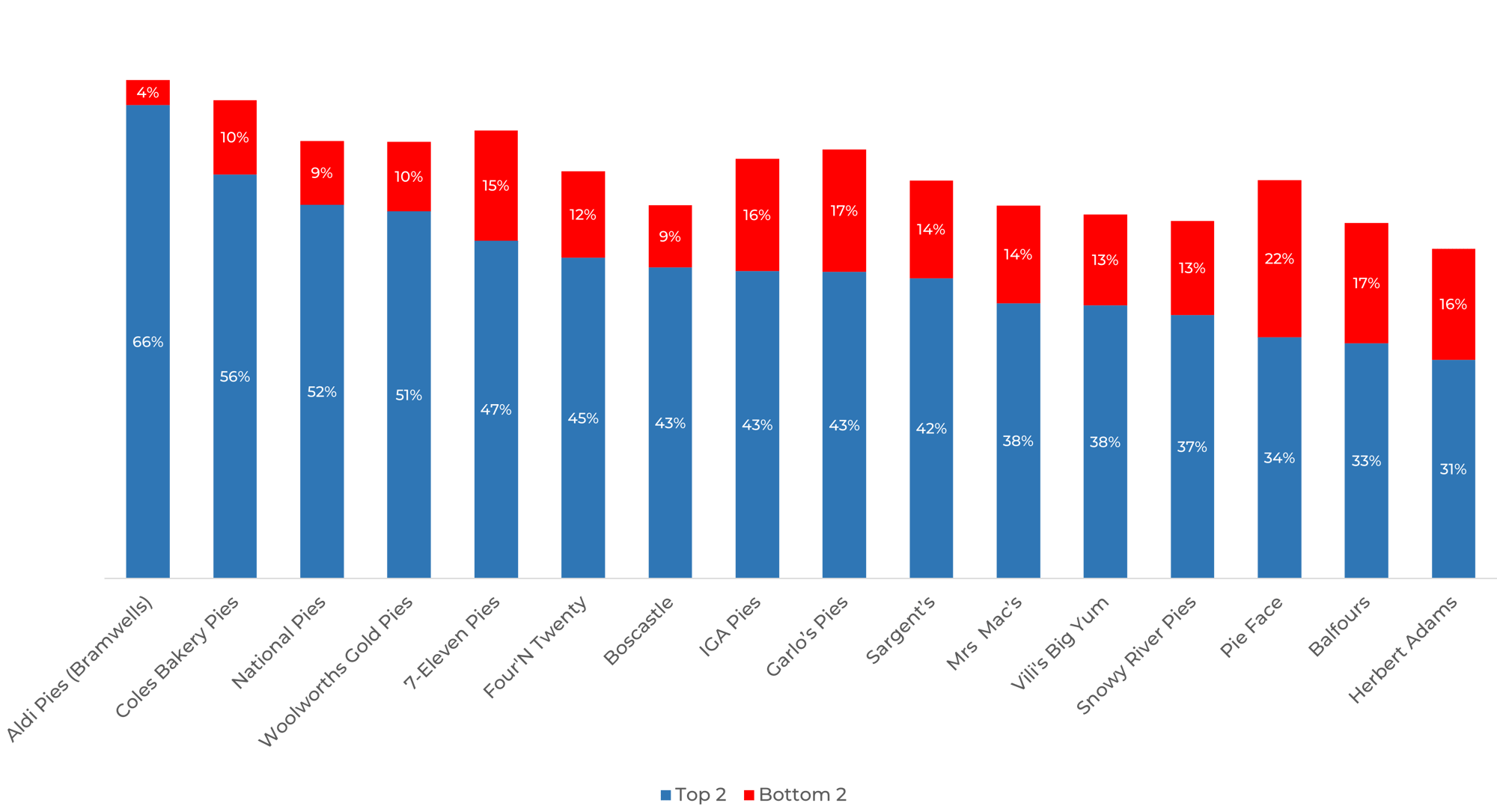

VALUE FOR MONEY: Aligning Perception with Brand Strategy

Value for money is a critical attribute, especially for brands positioned as cost-effective options. Aldi Pies (Bramwells) excels in this area, with 66% of consumers rating it highly and only 4% rating it poorly. This aligns perfectly with Aldi’s broader market strategy of offering quality products at competitive prices, making it the go-to choice for budget-conscious consumers.

Coles Bakery Pies and National Pies also perform well in value, with 56% and 52% Top 2 Box scores, respectively. Both brands are seen as offering good value for money, which is essential for maintaining their market positions. Their relatively low Bottom 2 Box scores (10% and 9%) further reinforce their appeal as value-for-money options.

Interestingly, Four'N Twenty and Woolworths Gold Pies, while more mainstream, also score well in this category, with 45% and 51% of consumers rating them positively. These brands are likely balancing quality and affordability, appealing to a broad consumer base that seeks a combination of both.

Premium brands like Herbert Adams and Boscastle naturally score lower on value for money, with 31% and 43% Top 2 Box scores, respectively. This is expected, given that these brands are positioned as premium options where consumers are willing to pay more for perceived higher quality. Their higher Bottom 2 Box scores (16% for both) reflect the fact that value-oriented consumers may find these brands too expensive, but this does not necessarily detract from their overall market positioning.

At the lower end, Pie Face and Balfours face challenges in value perception, with 34% and 33% Top 2 Box scores and higher Bottom 2 Box scores (22% and 17%). These brands may need to either adjust their pricing or more effectively communicate the value they offer to improve consumer perceptions.

Strategic Implications

Understanding how each brand's performance in these key attributes aligns with their market positioning offers critical insights:

- Premium Brands: For brands like Boscastle and Herbert Adams, the focus should remain on maintaining high quality and taste while accepting that their value for money perceptions will naturally be lower. Their premium pricing is justified by their superior product attributes, and their strategy should continue to emphasise this quality differentiation.

- Mainstream Brands: Four'N Twenty and Pie Face are well-positioned to appeal to a broad market, but they should consider enhancing their variety and value perceptions to further solidify their market position. Balancing these attributes will be key to appealing to both quality-focused and value-conscious consumers.

- Value Brands: Aldi Pies (Bramwells) and Coles Bakery Pies are performing well in value for money, which is central to their positioning. These brands should continue to emphasise their cost-effectiveness while ensuring that quality and taste do not fall behind.

- Underperforming Brands: Brands like IGA Pies and 7-Eleven Pies face significant challenges across multiple attributes. These brands may need to undergo a strategic overhaul, focusing on product improvements and better marketing to shift consumer perceptions positively.

SECTION 3: DEMOGRAPHIC AND GEOGRAPHIC INSIGHTS

Consumer preferences and brand awareness often vary significantly across different demographic and geographic segments. Understanding these variations allows brands to tailor their marketing strategies more effectively, targeting specific groups with messages that resonate. This section will explore how brand awareness and preference differ across gender, age, and location within Australia.

Demographic Insights: Gender and Age Group Variations

When analysing the data by gender, Four'N Twenty emerges as the most recognised and preferred brand across both men and women, with a nearly equal preference rate of 29%. This indicates a broad appeal that transcends gender lines, making Four'N Twenty a staple in the Australian pie market. However, other brands exhibit more pronounced gender differences. For example, Mrs. Mac’s shows a slightly higher preference among men (12%) compared to women (9%), suggesting that marketing strategies could be refined to address this gender disparity.

Age is another factor influencing brand awareness and preference. Four'N Twenty shows strong preference across all age groups but is particularly favoured by the 65+ age group (33%). This could be due to the brand's long-standing presence and traditional appeal, which resonates with older consumers who value familiarity. Conversely, Herbert Adams sees increasing preference with age, peaking among those aged 55-64 years at 19%. This trend suggests that Herbert Adams’ premium positioning aligns well with older consumers who may prioritise quality over cost.

In contrast, younger consumers exhibit different brand preferences. 7-Eleven Pies is more popular among the 18-24 age group, with a 14% preference rate, indicating that convenience and accessibility are key factors for younger consumers. Similarly, Pie Face appeals to the 25-34 age group, with a 10% preference rate, reflecting the brand's alignment with the on-the-go lifestyle of younger Australians.

Geographic Insights: Regional Brand Loyalty

Geographic differences also play a significant role in shaping brand awareness and preference. Four'N Twenty enjoys widespread recognition across most states, with particularly high awareness in Victoria (93%) and preference in Victoria (38%) and South Australia (37%). This regional dominance suggests that Four'N Twenty has successfully established itself as a household name, particularly in areas where it has strong distribution networks and local brand recognition.

Balfours shows strong regional loyalty in South Australia, where it commands a 30% preference rate, significantly higher than in other regions. This reflects the brand's local heritage and deep-rooted connection to the South Australian community. Similarly, National Pies is overwhelmingly preferred in Tasmania, where it originates, with a 75% preference rate. This highlights the importance of local brand origin in building strong regional loyalty.

On the other hand, brands like Garlo’s Pies and Snowy River Pies have limited regional appeal, with preference rates below 5% in most areas. These brands might need to consider strategies to increase their visibility and attractiveness outside their core regions, potentially through targeted marketing campaigns that resonate with the cultural and culinary preferences of other regions.

SECTION 4: STRATEGIC RECOMMENDATIONS FOR MARKETERS

The data gathered from this study offers rich insights into the dynamics of the Australian pie market, revealing both opportunities and challenges for brands aiming to enhance their market position. In this section, we’ll translate these insights into actionable strategies that marketers can use to strengthen their brand’s presence, improve consumer loyalty, and ultimately drive sales.

1. Leverage Brand Awareness to Increase Preference

For brands with high awareness but lower preference conversion rates, the focus should be on bridging this gap. Mrs. Mac’s and Balfours, for instance, enjoy relatively strong brand recognition but convert only 14% of that awareness, respectively, into preference. To improve these figures, these brands could consider the following strategies:

- Enhance Brand Messaging: Clearly communicate the unique selling propositions (USPs) that differentiate your brand from competitors. For Mrs. Mac’s, this could mean emphasising its traditional baking methods and local heritage, while Balfours could highlight its South Australian roots and long-standing community ties.

- Consumer Experience Optimisation: Improving the product experience through packaging, product innovations, or in-store promotions can create a stronger connection with consumers. For example, introducing limited-edition flavours or collaborating with local chefs for special releases could reinvigorate consumer interest and preference.

- Targeted Advertising Campaigns: Use targeted digital advertising to reach specific demographics that show awareness but low preference. This could include personalised content that resonates with consumer pain points, such as highlighting the value for money, improved taste, or superior quality.

2. Strengthen Brand Positioning Through Quality and Taste

For brands like Herbert Adams and Boscastle, which are already recognised for their high quality and taste, the goal should be to maintain and further build on these strengths. Here’s how these brands can continue to enhance their market position:

- Premium Product Lines: Consider launching or expanding premium product lines that build on the brand’s reputation for quality. This could include gourmet options, organic ingredients, or limited-edition offerings that appeal to discerning consumers.

- Quality Assurance Messaging: Reinforce the brand’s commitment to quality through marketing campaigns that highlight the sourcing of ingredients, the craftsmanship involved in production, and the rigorous quality checks that ensure each product meets high standards.

- Tasting Events and Consumer Trials: Organising in-store tasting events or offering free samples through online orders can directly engage consumers and give them firsthand experience of the brand’s superior taste and quality. This strategy can be particularly effective in converting consumers who are aware of the brand but have not yet made a purchase.

3. Tailor Marketing Strategies to Demographics and Regions

The demographic and geographic insights from this study suggest that a one-size-fits-all approach may not be the most effective strategy for all brands. Instead, marketers should tailor their strategies to resonate with specific consumer segments:

- Age-Specific Campaigns: Brands like 7-Eleven Pies and Pie Face have a strong following among younger consumers. To capitalise on this, they could implement social media campaigns that align with the values and behaviours of this demographic, such as sustainability, convenience, and affordability. Collaborations with influencers or partnerships with youth-oriented events could also enhance brand visibility among younger consumers.

- Gender-Specific Marketing: Herbert Adams, which appeals more to female consumers, could benefit from campaigns that focus on health-conscious messaging, premium ingredients, and convenience, which are often key considerations for female shoppers. For brands with a stronger appeal to males, such as Mrs. Mac’s, emphasising hearty, robust flavours and traditional recipes might resonate more.

- Localised Marketing Efforts: Brands like National Pies in Tasmania and Balfours in South Australia have strong regional loyalty, which they can leverage through localised marketing efforts. Investing in community sponsorships, regional events, and partnerships with local retailers can further entrench these brands within their home markets. For brands looking to expand their regional presence, understanding the local culture and consumer behaviour in target areas will be key. Tailored messaging that resonates with local preferences can help brands like Garlo’s Pies gain a stronger foothold outside their current strongholds.

4. Focus on Value Perception

In the current economic climate, where consumers are increasingly price-sensitive, the perception of value for money is critical. Brands like Aldi Pies (Bramwells) and Vili's Big Yum have successfully positioned themselves as offering good value, with conversion rates of 15% and 20% respectively. Other brands could enhance their value proposition through the following strategies:

- Price Promotions: Offering discounts, multi-buy offers, or loyalty programs can make consumers feel they are getting more for their money, which can be a significant driver of preference in a competitive market.

- Communicate Value: Highlight the value proposition in marketing communications. This could include messaging around the quality-to-price ratio, the convenience of the product, or the brand’s commitment to using high-quality ingredients at an affordable price.

- Product Bundling: Consider offering product bundles that provide consumers with a perceived higher value. For example, pairing pies with complementary products like sauces or beverages at a discounted price could appeal to budget-conscious shoppers.

5. Innovation and Product Development

For brands looking to stand out in a crowded market, innovation is key. Whether it’s through new flavours, healthier options, or sustainable packaging, innovation can differentiate a brand and attract new consumers.

- New Product Lines: Brands could consider introducing healthier pie options, such as those with lower fat content, gluten-free options, or pies made with organic ingredients, to appeal to health-conscious consumers. Innovative flavours or limited time offers can also generate excitement and attract attention.

- Sustainable Practices: As sustainability becomes an increasingly important factor for consumers, brands that adopt and communicate eco-friendly practices in sourcing, production, and packaging can enhance their appeal, particularly among younger consumers who prioritise environmental impact.

CONCLUSION

As we draw insights from the comprehensive analysis of the Australian pie market, it becomes evident that understanding consumer preferences goes far beyond simple brand recognition. The data shows that while brand awareness is crucial, it’s the ability to convert that awareness into brand preference that ultimately determines success in the marketplace. This case study has highlighted the varied performance of different pie brands, uncovering the factors that drive consumer choice and loyalty.

Summary of Key Insights

Throughout this case study, we’ve identified several key trends that can inform broader marketing strategies:

1. Brand Awareness vs. Preference Conversion:

-

- Four'N Twenty stands out as the leader in converting brand awareness into consumer preference, a testament to its long-standing market presence and consistent brand messaging.

- Herbert Adams also performs strongly, particularly among older consumers, suggesting that premium positioning and quality are critical drivers of preference.

- Brands with lower conversion rates, such as IGA Pies and Snowy River Pies, face challenges in aligning consumer perceptions with their offerings, indicating the need for a strategic reassessment.

2. Consumer Perceptions of Quality, Taste, and Value:

-

- High ratings for quality and taste significantly contribute to brand preference, as seen with Herbert Adams and Boscastle. For brands looking to improve their market position, enhancing these attributes should be a priority.

- Value for money remains a crucial factor, especially in a price-sensitive market. Brands like Aldi Pies and Vili's Big Yum demonstrate that even in the premium segment, a well-communicated value proposition can lead to higher consumer preference.

3. Demographic and Geographic Variations:

-

- Consumer preferences vary widely across different demographics and regions. For example, 7-Eleven Pies and Pie Face appeal more to younger consumers, while Four'N Twenty enjoys broad appeal across age groups, particularly among older demographics.

- Regional loyalty plays a significant role in brand preference, with National Pies dominating in Tasmania and Balfours in South Australia. These insights underscore the importance of localised marketing efforts.

The insights gained from this case study not only provide a detailed understanding of the Australian pie market but also offer valuable lessons that can be applied across industries. Whether it’s leveraging brand awareness, enhancing product quality, or tailoring marketing strategies to specific demographics, the key to success lies in understanding and responding to the nuances of consumer behaviour.

By focusing on the strategies outlined in this study, such as improving brand messaging, innovating product offerings, and targeting marketing efforts, brands can better align with consumer expectations, foster loyalty, and drive growth. The Australian pie market, while unique in many ways, serves as a microcosm of broader consumer trends, offering insights that are both specific and widely applicable.

If you’re a marketer or brand manager looking to deepen your understanding of consumer preferences and enhance your brand’s market position, this case study offers a wealth of actionable insights. By applying these strategies, you can improve your brand’s performance and achieve greater success in an increasingly competitive market.

If you're ready to take your brand to the next level, we're here to help. Get in touch with us to schedule a free 30-minute brand research strategy session. We'll work with you to audit your brand and market environment, providing you with tailored strategic recommendations to drive consumer loyalty and growth. Simply click this link to book your session today.

.png%3Fwidth=390%26height=50%26name=Layer_1%20(1)-1.png)